Kathmandu. Insurance companies have estimated that claims worth about $22 billion will be made in the riots that erupted after the anti-corruption movement sparked the Gen G movement.

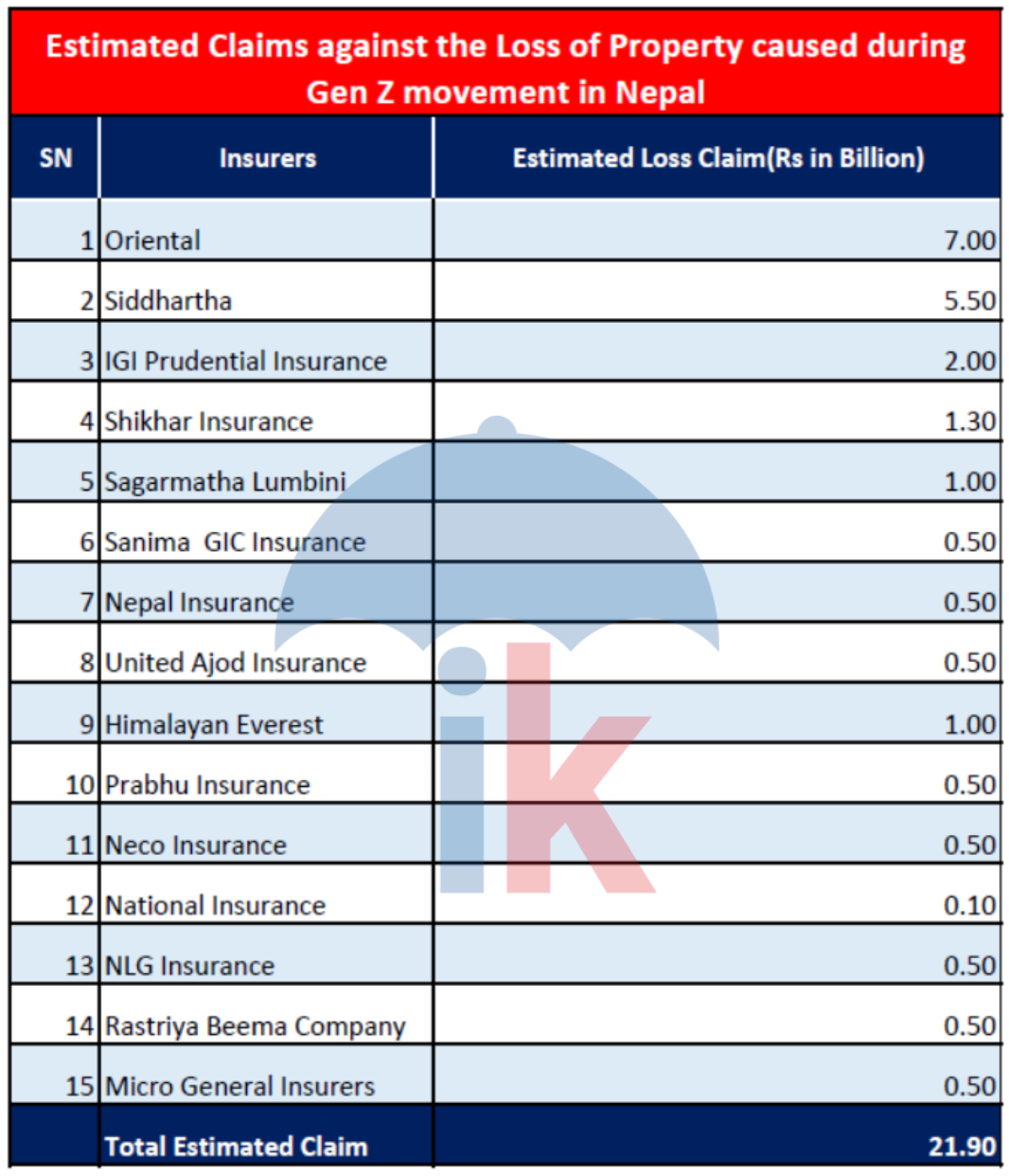

According to preliminary data obtained by Insurance Khabar, the 14 licensed non-life insurers are expected to claim compensation worth Rs 21.4 billion for vandalism, arson and mob riots during the Gen G movement.

Oriental Insurance Limited, the Nepal branch of the non-life insurance company of India, is expected to claim the highest amount of Rs 7 billion. Out of this, a large amount is from the Hilton Hotel building in Naxal, which is operated by Shankar Group. The hotel has been re-insured by Nepal Reinsurance Company and Himalayan Reinsurance.

Similarly, National Insurance estimates that the minimum compensation claim will be made. National Insurance has estimated a compensation claim of Rs 10 crore.

Siddhartha Premier Insurance has estimated a claim of around Rs 5.50 billion. The amount also includes damage caused to the industrial premises of the Chaudhary Group at Satungal.

Birendra Bahadur Baidawar Chhetri, president of the Non-Life Insurance Association, said that the claim would be paid under the Huldang Insurance Scheme. He said that if the mob riot insurance is not included, the insured may not be compensated for the loss of such property.

There have been unimaginable incidents of vandalism, looting and arson of vehicles, commercial buildings, educational institutions, vehicles, big business centers in different districts of the country during the demonstrations that took place on September 24.

Most of the business establishments have a tendency to provide property insurance without including mob riot insurance with the aim of reducing the expenses of the insurance in the recent period, saying that riots will not occur due to political upheaval or other reasons in Nepal in recent times. But this time, the destruction has raised the possibility of unexpected riots in Nepal at any time.

IGI Prudential Insurance is expected to claim Rs 2 billion while Shikhar Insurance is expected to claim Rs 1.30 billion. Sagarmatha Lumbini Insurance and Himalayan Everest Insurance have also estimated to claim Rs 1 billion respectively.

Sanima GIC, United Ajod, Prabhu Insurance, Neco and NLG have filed a claim of Rs 50 crore respectively. According to preliminary estimates, the state-owned National Insurance Company will also face claims worth Rs 50 crore.

Apart from this, it is estimated that the small non-life insurer has to pay a compensation claim of Rs 50 crore. Most of the insurance provided by Lugh Non-Life Insurance is part of the motor insurance.

If all these companies have adequate reinsurance arrangements, they will not have to bear all the burden equal to the claim. In addition, two licensed domestic reinsurance companies have also stated that they do not have to pay a large amount of compensation claim as they have adequate retrocession insurance to cover the risk of mob riots.