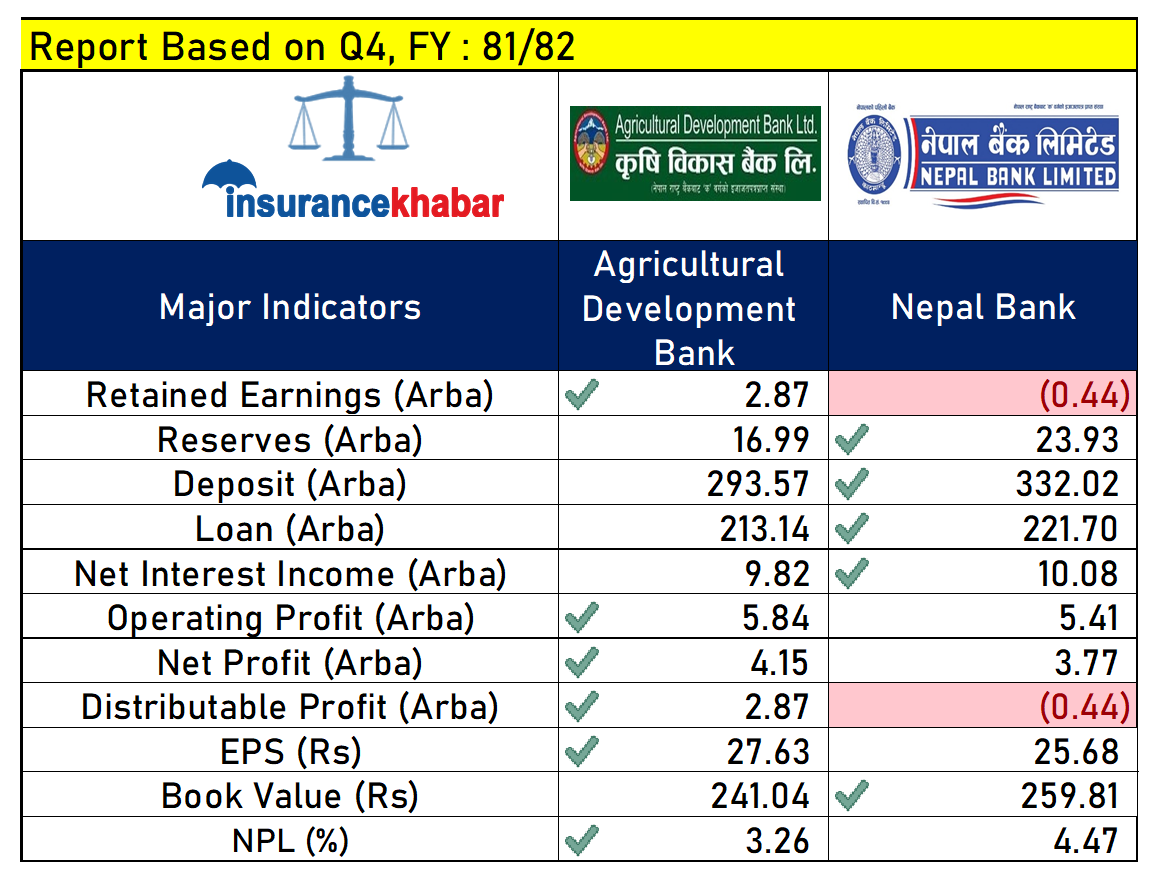

Kathmandu. Agricultural Development Bank and Nepal Bank are the two commercial banks with government investment. Both banks were in the last fiscal year 2081. A comparative study conducted by Insurance Khabar on the basis of key financial indicators between the two banks in the context of the disclosure of financial statements for the fourth quarter of 2018-18:

Agricultural Development Bank’s retained earnings stood at Rs 2.87 billion, while Nepal Bank’s retained earnings stood at Rs 440 million.TAG_CLOSE_span_35 TAG_CLOSE_strong_46 TAG_OPEN_strong_46

Agriculture Development Bank has a reserve fund of Rs 16.99 billion while Nepal Bank has a reserve fund of Rs 23.93 billion.TAG_CLOSE_span_34 TAG_CLOSE_strong_45 TAG_OPEN_strong_45

Agricultural Development Bank (ADB) has collected deposits of Rs 293 billion and extended loans worth Rs TAG_CLOSE_span_33 TAG_CLOSE_strong_44 TAG_OPEN_strong_44 213 billion, while Nepal Bank has collected deposits of Rs 332 billion and disbursed loans of Rs 221 billion.

Agricultural Development Bank (ADB) has earned a net interest income of Rs 9.82 billion while Nepal Bank has earned Rs 10.08 billion.TAG_CLOSE_span_32 TAG_CLOSE_strong_43 TAG_OPEN_strong_43

Operating Profit of Rs. 5.TAG_OPEN_strong_42.}}} Operating Profit of Rs. 5.84 billion and Operating Profit of Rs. 5.41 Arba.

Agricultural Development Bank (ADB) earned a net profit of Rs 4.15 billion while Nepal Bank earned a net profit of Rs 3.77 billion.TAG_CLOSE_span_30 TAG_CLOSE_strong_41 TAG_OPEN_strong_41

Agricultural Development Bank (ADB) has a distributable profit of Rs. 2.87 billion while Nepal Bank has a negative distributable profit of Rs. 440 million.TAG_CLOSE_span_29 TAG_CLOSE_strong_40 TAG_OPEN_strong_40

The book value of Agriculture Development Bank is Rs. 241.04 while that of Nepal Bank is Rs. 259.81.TAG_CLOSE_span_28 TAG_CLOSE_strong_39 TAG_OPEN_strong_39

Based on the financial statements, Agricultural Development Bank has EPS of Rs. 27.63 while Nepal Bank has EPS of Rs. 25.68.TAG_CLOSE_span_27 TAG_CLOSE_strong_38 TAG_OPEN_strong_38

Bad Loans: Agricultural Development Bank has bad loans of 3.26 percent while Nepal Bank has bad loans of 4.47 percent.

(Note: The analysis based on the available data is not exhaustive.) Do more research and make a decision. The above news is not for share trading purposes. )