Kathmandu. Nepal Insurance Authority (INSURANCE) has issued integrated investment guidelines for insurance companies titled ‘Insurance’s Investment Directive, 2082’.

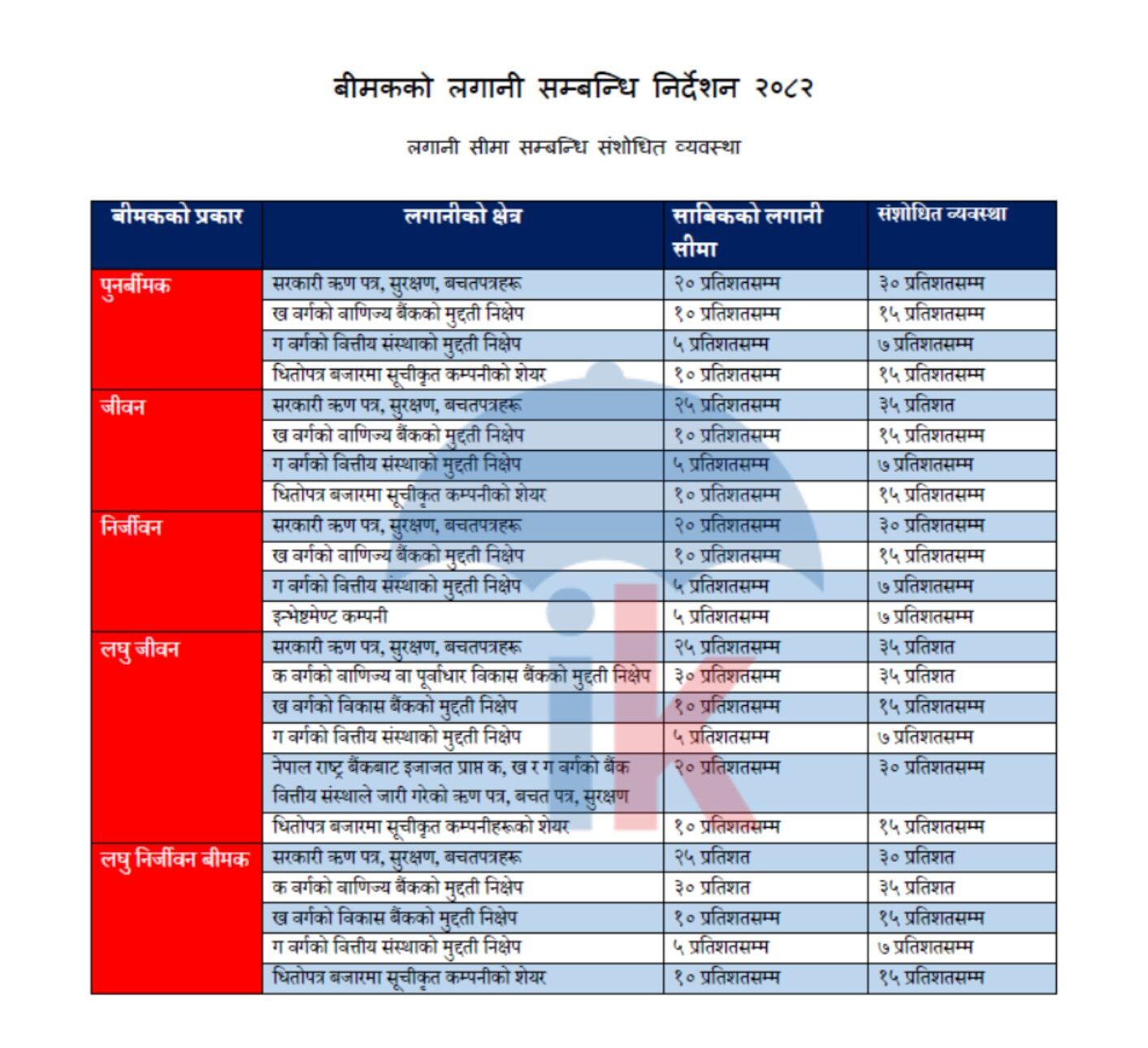

It has amended the investment guidelines of the insurer and issued a unified directive applicable to all types of insurers. Earlier, different types of insurance businesses had different guidelines for the investment of insurers. With the issuance of the new investment directive, all the four old directives have been canceled.

To set up a separate investment unit:

NeA has been mandated to set up an investment management unit under the supervision of high management level employees with experience in investment related work to manage the investment by the insurer. That is, only employees of a post higher than the post of manager will be able to be the head of such a unit.

The board of directors, the top management, the executive chief and the head of the investment management unit will be responsible for the purchase price of the investment made by the insurer, the purchase process, the issue of compliance with the prevailing laws and the consequences after the investment.

No restrictions on investment in government loans:

There will be no restrictions and limits on investment in government bonds and Nepal And Nepal Rastra Bank bonds. The limit of investment that insurers can make in the listed securities market has been increased from 10 percent to 15 percent.

Except for taking the approval of the AUTHORITY as per the Insurance Act, 2079 BS, it is not necessary to take the approval of the AUTHORITY while making an investment subject to the limits and conditions of the investment mentioned in this directive. In the directive, investment has been prohibited in areas other than those specified by the AUTHORITY.

Provision of investment in subsidiaries remains the same:

According to the provision, the insurer can invest in agricultural production, storage, distribution, storage house and cold house, energy production, broadcasting and details, education and health and subsidiaries for carrying out business of investment companies with prior approval of nea so as not to increase to 5 percent of the total investment.

The insurer will not be allowed to invest in any security letter or equipment issued by the subsidiary company and the subsidiary company will not be allowed to invest in the shares and other equipment issued by the insurer.