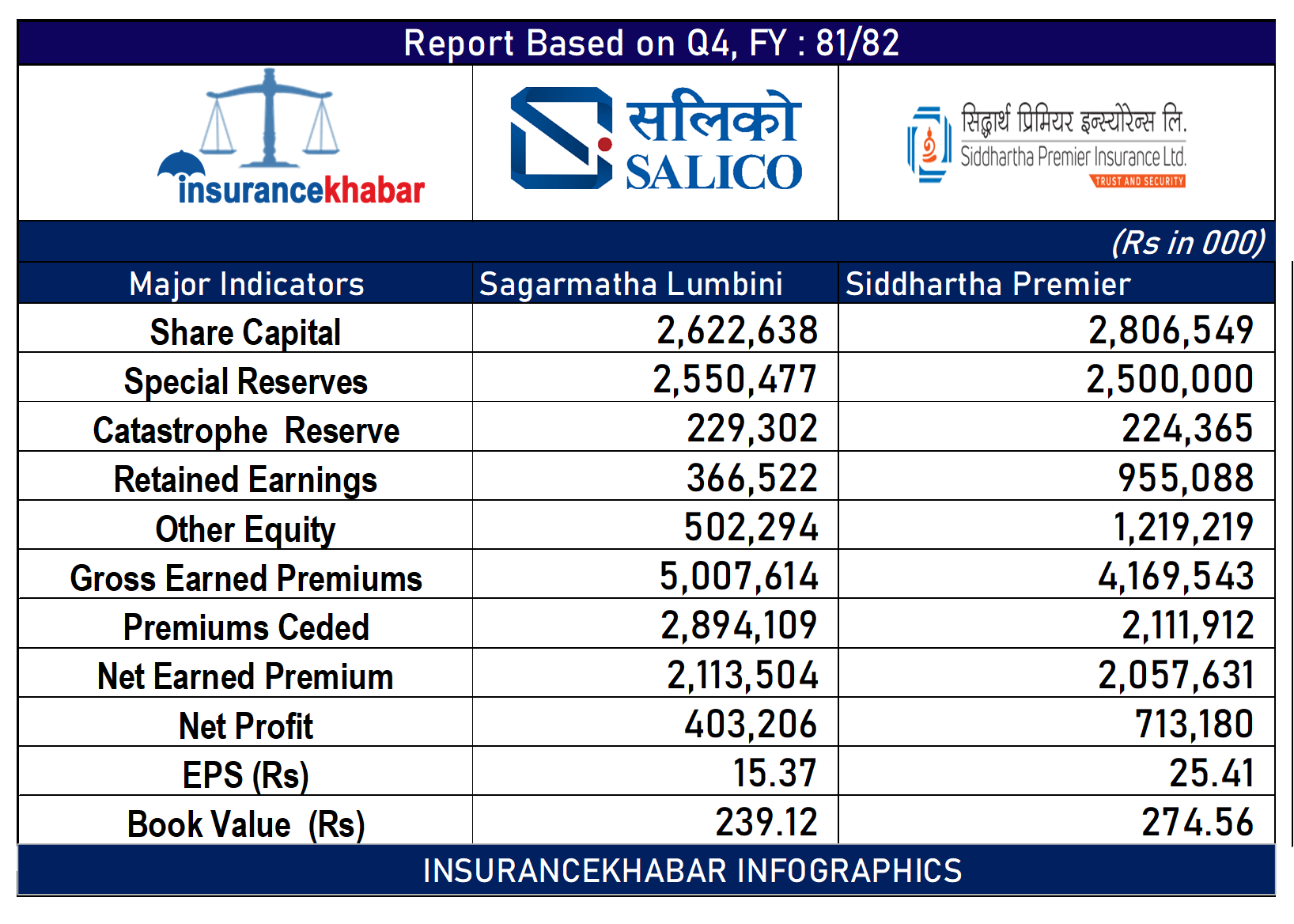

Kathmandu. Sagarmatha Lumbini Insurance and Siddhartha Premier Insurance last fiscal year 2081. The financial statements for the fourth quarter of 1982 have already been made public. Based on the same financial statements, a comparative study conducted by Insurance Khabar to these two insurance companies:

paid-up capital: published by companies in the last fiscal year 2081. Based on the financial statements of the fourth quarter of 2018-19, Sagarmatha Lumbini Insurance has a paid-up capital of Rs 2.62 billion while Siddhartha Premier Insurance has a paid-up capital of Rs 2.80 billion.

Special Reserve: Sagarmatha Lumbini Insurance has Rs 2.55 billion in special reserve and Siddhartha Premier Insurance has Rs 2.5 billion in special reserve.

Great Disaster Fund: Sagarmatha Lumbini Insurance has Rs 229.3 million in disaster fund and Siddhartha Premier Insurance has Rs 224.3 million in disaster fund.

retained earnings: Sagarmatha Lumbini Insurance has a retained earning of Rs 366.5 million while Siddhartha Premier Insurance has a retained earning of Rs 955 million.

Other equity: {{TAG_OPEN_strong_39 TAG_CLOSE_strong_39}} Sagarmatha Lumbini Insurance has Rs 502.2 million in other equities while Siddhartha Premier Insurance has Rs 1.21 billion in other equities.

Sagarmatha Lumbini Insurance has earn TAG_CLOSE_strong_38 ed Rs 5 billion in insurance premiums till the fourth quarter TAG_CLOSE_span_27 of the last fiscal year while Siddhartha Premier Insurance has earned Rs 4.16 billion in total insurance premiums. TAG_OPEN_strong_38

Sagarmatha Lumbini Insurance has earn TAG_CLOSE_strong_37 ed Rs 2.11 billion in net insurance premium till the fourth quarter TAG_CLOSE_span_26 of the last fiscal year while Siddhartha Premier Insurance has earned Rs 2.05 billion in net insurance premium. TAG_OPEN_strong_37

Net Profit: Sagarmatha Lumbini Insurance has made a net profit of Rs 403.2 million till the fourth quarter, while Siddhartha Premier Insurance has made a net profit of Rs 713.1 million.

Earnings per share: Sagarmatha Lumbini Insurance has an annual earnings of Rs 15.37 per share while Siddhartha Premier Insurance has an annual income of Rs 25.41.

Net worth per share: Sagarmatha Lumbini Insurance has a net worth of Rs 239.12 per share while Siddhartha Premier Insurance has a net worth of Rs 274.56.

(Note: The available data is prepared from the financial statements published by the company.) This analysis is not complete. Investors will have to investigate further before making a decision on the transaction. )

(Note: The available data is prepared from the financial statements published by the company.) This analysis is not complete. Investors will have to investigate further before making a decision on the transaction. )