Kathmandu. Nepal Insurance Authority (NEA) fiscal year 2081. Based on the actuarial evaluation report approved by mid-July 82, the solvency ratio of non-life insurance companies has been made public.

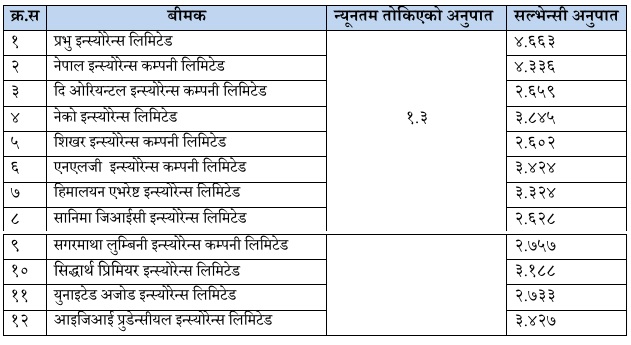

NeA has made public the solvency ratio of 12 non-life insurers through insurance reflection. In the last financial year, the average solvency ratio of these non-life insurers was 3.30. Which is more than double the solvency ratio fixed by the AUTHORITY for non-life insurers. NeA has fixed solvency ratio of 1.3 for non-life insurers.

The solvency ratio of the non-life insurers approved by the AUTHORITY is from a minimum of 2.60 to a maximum of 4.66.

According to the NRA, Prabhu Insurance has the highest solvency ratio of 4.66 on the basis of insurance valuation. Similarly, Nepal Insurance has the second highest number of 4.37.

Shikhar Insurance has the lowest solvency ratio of 2.60.

According to the AUTHORITY, the solvency ratio of all non-life insurers is above the minimum regulatory standards. This means all non-life insurers are fully capable of meeting financial obligations.

An insurer with a solvency ratio of less than 1 is considered financially unhealthy, and regulatory oversight of such insurers becomes tighter. Less than 1 means that the insurer does not have sufficient assets to meet the financial obligations to the insured and other moneylenders. Having a solvency ratio of 1.3 means that the insurer will have to pay Rs 1 to meet the liability of Rs 1. Capital assets worth Rs 1.30 are available.