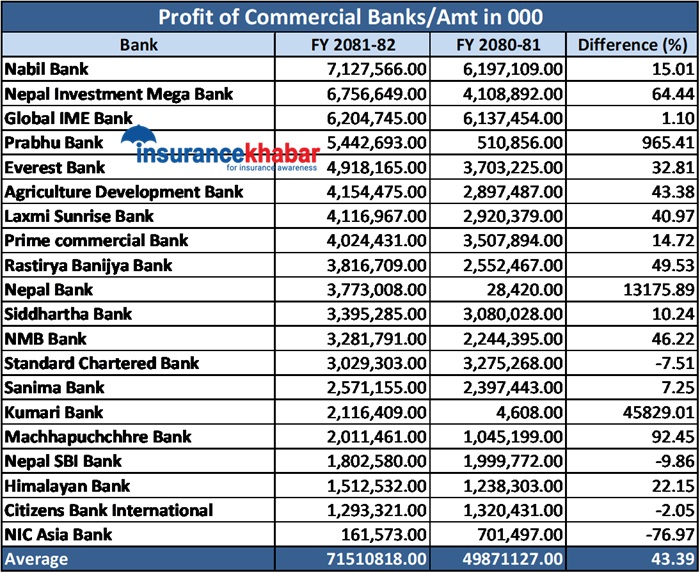

Kathmandu. Commercial banks last fiscal year 2081. They have earned a profit of Rs 71.5 billion in 2018.

According to the financial statements released by the banks, 20 commercial banks have earned a total of Rs 71.51 billion. Last year 2080. The banks had posted a net profit of Rs 49.87 billion in 2017-19. The bank’s profit has increased by 43.39 percent compared to the previous year.

Compared to the previous year, the profit of 16 commercial banks has increased and the profit of four banks has decreased in the review year. Nabil Bank is the highest profit-making bank in the review year while Kumari Bank is ahead in terms of growth rate.

Nabil Bank has earned a profit of Rs 7.12 billion in the review year. In the previous fiscal year, the bank had posted a profit of Rs 6.19 billion. The bank’s profit increased by 15.01 percent in the review year compared to the previous year.

Nepal Investment Mega Bank is the second highest profit-making bank in the review year. The bank has earned a profit of Rs 6.75 billion. In the previous fiscal year, the bank had posted a profit of Rs 4.10 billion. The bank’s profit increased by 64.44 percent in the review year compared to the previous year.

Global IME Bank is in third place. The bank has earned a profit of Rs 6.20 billion. In the previous fiscal year, the bank had earned Rs 6.13 billion. The bank’s profit increased by 1.10 percent in the review year compared to the previous year.

Similarly, Prabhu Bank has earned a profit of Rs 5.44 billion in the review year. In the previous year, the bank’s profit was limited to Rs 510 million. The bank’s profit has increased by 965.41 percent compared to the previous year.

In the last fiscal year, Everest Bank earned a profit of Rs 4.91 billion, Krishi Bikas Bank Rs 4.15 billion, Laxmi Sunrise Bank Rs 4.11 billion, Prime Bank Rs 4.24 billion and Rastriya Banijya Bank Rs 3.81 billion. The profit of all these banks has increased compared to the previous year.

In the review year, Nepal Bank has earned a profit of Rs 3.77 billion. This profit is 13175.89 percent more than the previous year.

Similarly, Siddhartha Bank earned a profit of Rs 3.39 billion, NMB Bank Rs 3.21 billion, Standard Chartered Bank Rs 3.02 billion and Sanima Bank Rs 2.57 billion. Siddhartha Bank, NMB Bank and Sanima Bank have reported a decline in profit compared to the previous year.

In the last fiscal year, Kumari Bank earned a profit of Rs 2.11 billion. This is an increase of 45829.01 percent compared to the previous year. This growth rate is also the highest among commercial banks.

Similarly, Machhapuchchhre Bank earned a profit of Rs 2.01 billion, Nepal SBI Bank Rs 1.80 billion, Himalayan Bank Rs 1.51 billion, Citizens Bank Rs 1.29 billion and NIC Asia Bank Rs 161.5 million in the review year. Machhapuchchhre Bank and Himalayan Bank have seen profits rising compared to the previous year, while Nepal SBI Bank, Citizens and NIC Asia Bank have declined.

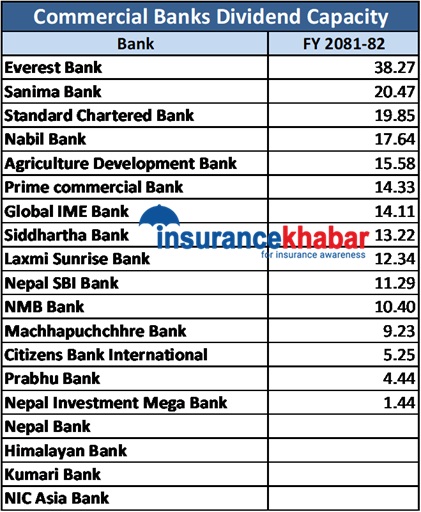

What is the dividend potential of which bank?

Out of the 19 commercial banks listed in NEPSE from the profits of the last fiscal year, 15 are likely to distribute dividends while four banks are unable to distribute it. Everest Bank has the highest dividend potential while Nepal Investment Mega Bank has the lowest dividend potential.

Everest Bank and Sanima Bank are expected to pay 38.27 per cent and 20.47 per cent dividend respectively for the review year. Standard Chartered Bank has 19.85 per cent dividend, Nabil 17.64 per cent, Krishi Bikas Bank 15.58 per cent, Prime Bank 14.33 per cent, Global IME Bank 14.11 per cent, Siddhartha Bank 13.22 per cent, Laxmi Sunrise Bank 12.34 per cent, Nepal SBI Bank 11.29 per cent and NMB Bank 10.40 per cent.

Similarly, Machhapuchchhre Bank can distribute 9.23 percent dividend, Citizens Bank 5.25 percent, Prabhu Bank 4.44 percent and Nepal Investment Mega Bank 1.44 percent.