- Nirmal Kumar Lamichhane

role

The development of professionalism in a life insurance agent means a balanced advancement of his knowledge, behavior, service and ethics. Which helps him to be successful and reliable in the long run. A life insurance agent or agency manager needs to be planned continuous and multi-dimensional in order to be a professional. For this, the active role of the company, the coach and the agent himself is important.

Development in knowledge and skills

Insurance knowledge: The agent must be fully aware of the characteristics, benefits, terms, exceptions, and claim process of each insurance plan he sells. It helps to answer customers’ questions properly and choose the right plan.

Market information: should be aware of the changes taking place in the insurance market, new products, plans of competing companies, and the overall economic situation.

Financial literacy: requires knowledge to help clients make financial plans.

Knowledge of financial plans: Must have knowledge of basic financial plans to recommend the right insurance plan according to the customer’s financial goals and needs.

Sales and communication skills: the ability to communicate effectively with customers, understand their needs, explain the benefits of insurance, and address people with negative views about insurance.

Participation in training: Continuous participation in training conducted by companies or various agencies.

Fair treatment and quality service

Life insurance agents play a responsible role not only in increasing insurance awareness in the customers but also in the society, so their high moral humanity and service spirit is necessary.

Business language and manners: use easy local languages (Nepali, Maithili, Bhojpuri, etc.) for customers to understand.

Explain complex insurance terminology (e.g. premium, rejection, fixation period) with examples in common language and local language.

If words that do not have two meanings, if words are used to confuse the customer, then the insured will not be able to explain the insurance information to other people from whom the insurance cannot be marketed.

Time management: To meet, follow up, according to the customer’s choice, the agent should be able to manage time by keeping himself always agile and agile.

Communication skills: should be clear, simple and capable of communicating according to customer standards, and accordingly communication should be proficient in the use of social networks.

Ethics and trust building

Give true information: Do not give false assurances to customers.

Maintaining confidentiality: Protecting customer personal details.

Transparency: Development of the ability to explain all the details and features of insurance plans.

Goal setting and evaluation

Personal goals: Keeping monthly and quarterly sales targets.

Self-assessment: Regular review of successes and weaknesses and improve them by making them evaluate their shortcomings from their superiors.

Effective use of technology

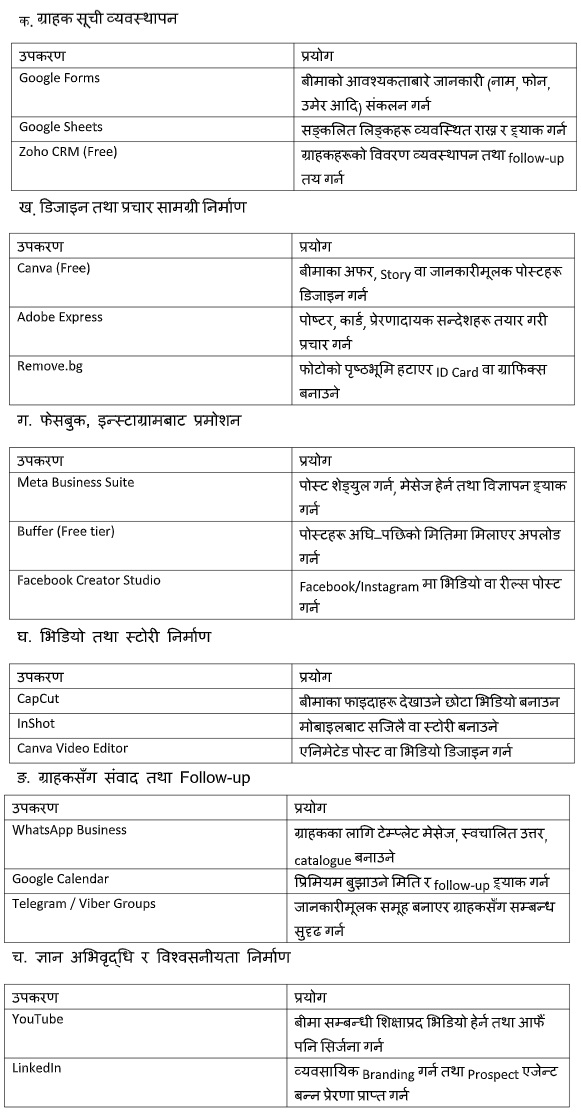

The following technologies can be used to make the insurance business more systematic, professional and result-oriented:

Customer database management

Digital social networks need to be used to collect, classify and track customers’ personal details.

Digital marketing

Through social media, e-mails, websites, etc., you can find target customers and inform them about the importance of financial security. Customer management and insurable customers can be identified using the following free tools:

Self-motivation and leadership

Self-motivation and leadership

To maintain continuity and honesty in self-discipline.

Training to share experiences to guide other agents.

Ethics and professional conduct

Honesty and transparency: the customer should be clearly informed about all terms and conditions of the insurance plan. No misinformation or false assurance should be given.

Customer-centric approach: should put customer interests above all else. They should recommend a plan according to their needs, not a plan to get more commissions.

Privacy: Privacy of customers’ personal and financial information should be maintained.

Regular contact: Should remain in regular contact with customers even after selling insurance to assist them in their claim processing and resolve any other queries.

Continuous learning and development

Training and workshop: must actively participate in various trainings, workshops, and seminars organized by insurance companies or regulatory bodies.

Use of modern technology: Make your work more effective by being aware of the use of insurance software, online social networks, and digital platforms.

Association with professional organizations: Can be associated with professional organizations of insurance agents to share knowledge and gain new information.

Self-discipline and management

Time management: Time management skills are needed to effectively meet customers, follow up, and manage administrative tasks.

Target Setting: Should work in a planned manner to achieve and determine clear and achievable sales targets.

Positive thinking: should be able to take rejections easily and move forward with positive thinking.

Networking: Networking is important for establishing good relationships with potential customers and other professionals.

By paying attention to all these aspects, life insurance agents can be successful in this profession by enhancing their professionalism.

Source: Various newspapers and social networks.

Lamichhane is the head of law and claims department of Reliable Nepal Life Insurance. )