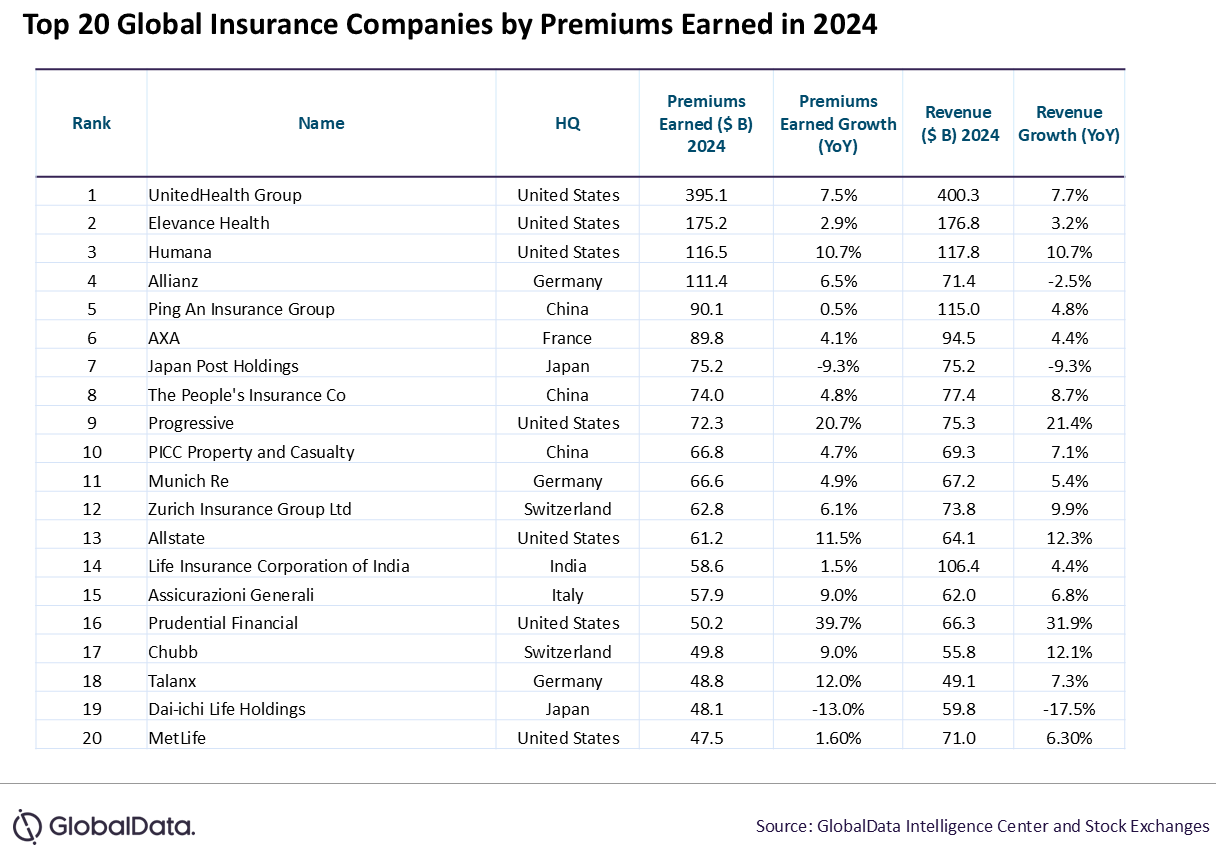

Kathmandu. The world’s top 20 publicly listed insurance companies reported an average growth of about 7% in business in 2024.

According to global data data, the business of these insurers increased by 6.8 percent in 2024 compared to the previous year. High interest rates, strong equity market returns and benefits from ongoing digital and geographic expansion are some of the reasons for the growth.

Out of these 20 companies, 18 have increased their insurance premium. Prudential Financial led the group to a 39.7 percent increase in insurance premiums. Which is driven by the growth of its group ‘Disability and Supplemental Health Business’ as well as strong variable life sales through its consulting network.

Progressive’s business grew by 20.7 percent. This is due to the increase in new personal vehicle insurance and higher insurance rates in the personal and commercial vehicle insurance segment.

Japan’s Dai-Ichi Life Holdings, on the other hand, reported a 13 per cent drop in insurance premiums due to weak sales of its Dai-ichi Frontier Life subsidiary.

Japan Post Holdings also reported a decline of 9.3 per cent. Which reflects the increased cost of issuing less applicable insurance policies and new insurance policies.

Global data analyst Murthy Grandi says the increase in insurance premiums reflects sweeping changes in consumer behaviour. “The business seems to have increased especially due to increasing financial literacy and demand for insurance products with savings elements,” he said.

Rising incomes and the expansion of the middle class are also increasing the demand for life insurance, especially in emerging markets. While job market volatility and rising healthcare costs are increasing interest in more flexible, customizable insurance options.

GlobalData expects insurers to face a more complex operating environment in 2025. Geopolitical tensions, including the war in Ukraine and instability in the Middle East, could disrupt the global reinsurance market and increase political risk, according to global data.

Similarly, continued trade tensions and tariff increases can weigh on investment sentiment and increase supply chain risk. This could prompt insurers to re-evaluate pricing models.